1099-G Tax Information

1099-G Update

1099-G forms for tax year 2023 are no longer available online. The state mailed forms to individuals on January 31. If you have a question about your form, call the 1099-G Information Line at (844) 500-4906.

February 13, 2024

Use your 1099-G Form to File your Taxes

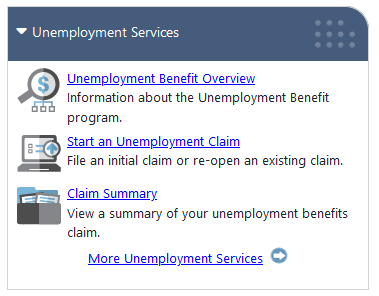

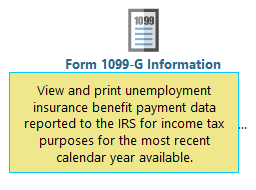

Your unemployment payments are reported as income to the IRS. If you have received unemployment insurance payments last year, you will need to report the total amount (as found on your 1099-G) on your federal taxes. The Form 1099-G reports the total taxable unemployment benefits paid to you from the Tennessee Department of Labor & Workforce Development for a calendar year and the federal income tax withheld, if applicable.

Your benefits are taxable and reportable on your federal return, but you do not need to attach a copy of the Form 1099-G to your federal income tax return. Benefits are reported based on the issue date of the payment, not the week ending date(s) that was paid.

Digital 1099-G documentation will be available by January 31, 2024.

For a timely arrival, please confirm or update, if necessary, the mailing address listed within your Jobs4TN.gov account.

This Page Last Updated: April 26, 2024 at 2:40 PM